Running Developments – what we do

Recovery of Mine Wastes through Recycling

We are fundamentally convinced that….

Recycled gold is created from consumer products like unwanted or broken jewellery, old coins, electrical scrap, and even old car parts. As a precious metal, gold does not degrade when it is melted down and reformed; this means it can be recycled over and over again without losing its integrity or its value.

According to the World Gold Council, recycled gold accounted for 28 percent of the total global gold supply of 4,633 metric tons in 2020. They found that 90 percent of that comes from discarded jewelry and the rest from electronic waste, like mobiles and laptops.

The products of mining activities are essential not only for the subsistence of modern society but also for its improvement. We can easily consider the impact of the absence of products in several industries, such as aviation, transportation, electronics, building materials, healthcare, agricultural products, asphalt, metals, and paints. Substantial mining activity is usually correlated with a region’s development, where geologically privileged regions can enhance their GDP considerably. For example, the European extractive industry includes more than 17,500 companies employing more than half a million people,

Global resources are finite, and greater extraction and use of virgin materials put significant pressure on the Earth’s resources, critically threatening future generational resource requirements. Furthermore, population growth generates high consumption, putting pressures never seen before on natural resources. Consequently, the mining industry is generating vast quantities of tailings per year, representing one of the more prominent waste producers worldwide, reaching 7 billion tonnes per year. Recent estimates point out that 19 billion tonnes of solid tailings will be accumulated by 2025. Waste generated due to mining activity is a serious issue and is often associated with the risks posed by its storage and environmental management.

Recycling of Gold and Silver mining waste utilizing specialized processes are both possible and economically viable. We are engaged with sites that hold significant reserves that will enable us to reintroduce a transformed waste as a raw material for the manufacture of new products which have the following advantages: generation of employment, encouragement of scientific development, and a reduction for extraction of minerals in mines.

Precious waste recycling development involves the recycling of excavated tailings after copper and gold mining and is strictly confidential and accessible only to LLP partners

The excavation site contains remnants of precious metals where the main element is gold in a content that allows for effective mining. The value of the gold reserves in the site at current market price is approximately 1.2 billion euros after deducting the costs of mining 1 value 700 million euros.

Due to European Union regulations, mining cannot be carried out using conventional methods. For mining, it is necessary to use mechanical separation that is specially developed for previously overburdened rocks, which uses unique technological processes that allow mining to usually mine microscopic particles of gold.

Chemical mining using cyanide, which would be suitable for the site, is prohibited in the European Union for environmental reasons.

An important element of the entire project is that the mined site is already in the company's reserves and the gold content and can therefore be booked directly to reserves'

Our premium microchip development is an energy saving development and is strictly confidential and accessible only to LLP – partners

We are fundamentally convinced that…

The microchip industry is predicted to grow from $575 billion in 2022 into a trillion-dollar industry by 2030. The main obstacles are limited production capacity and unstable production chains. Europe’s strengths in the microchip industry are the presence of equipment-producing companies, research institutes, and the region’s production of customary microchips for the automotive and industrial sectors that will grow in demand. Europe’s challenges are the production capacity, limited and expensive workforce, and potentially threatened supply routes. Europe consumes 20% of the world’s chip supply. The €45 billion European Chips Act seeks to increase the European global production share from 9% in 2022 to 20% in 2030. However, this agenda focuses on establishing state-of-the-art microchip factories in Europe, even though there is no demand for these on the continent. Arguably a more all-encompassing approach, including investments in the existing producers of customary chips, R&D, design, and suppliers of microchip material, chemicals, and equipment, is more sensible. A balance between securing the production chain and continuing cooperation with reliable trade partners such as the U.S., South Korea, Taiwan, and Japan is required. China’s politics are the main threat to the microchip market. Therefore, its development in this sector should be slowed down, until the government changes to a more cordial stance.

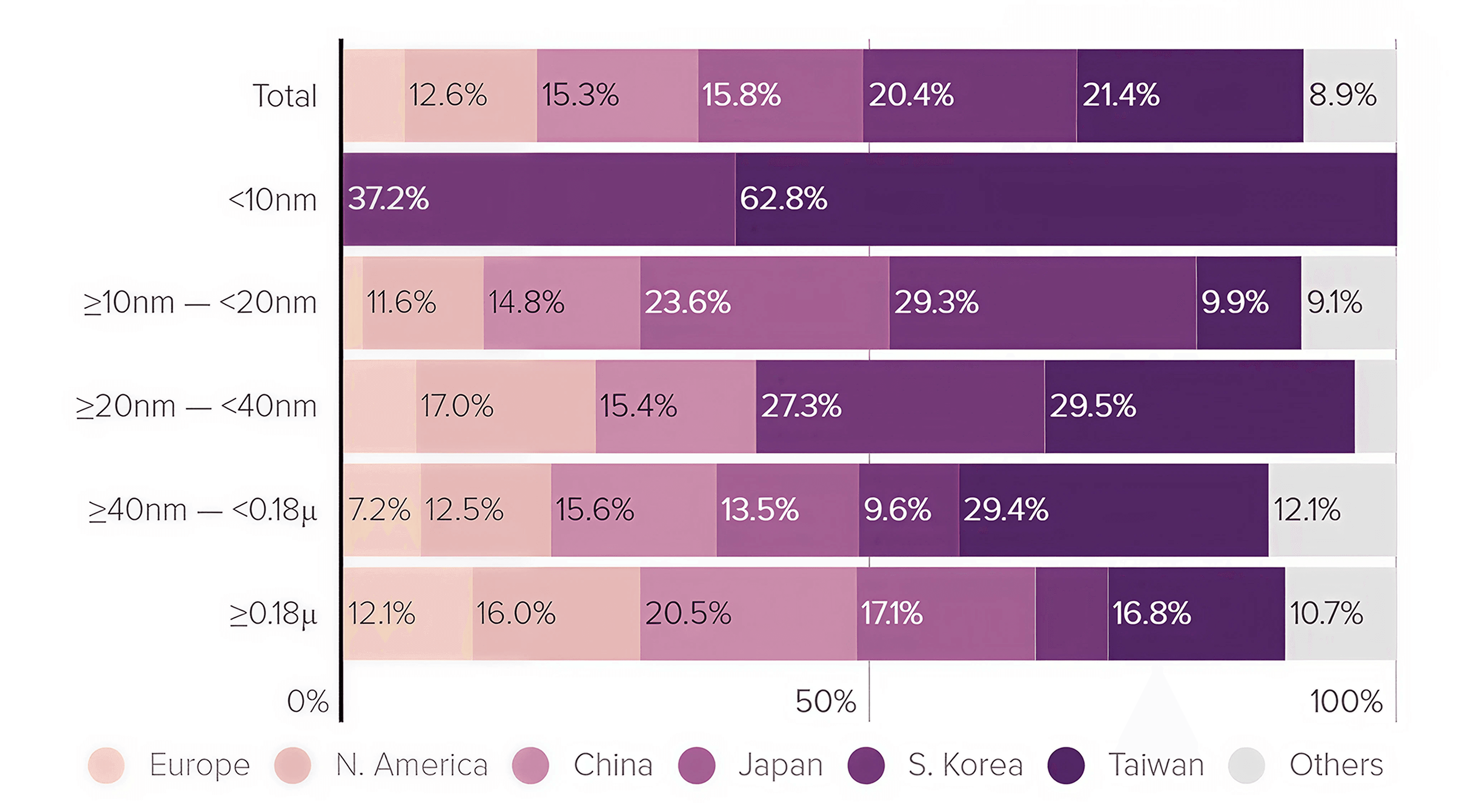

The primary producers are Taiwan, South Korea, China, the United States, and Europe. However, only South Korea and Taiwan can economically produce the most advanced microchips. These designs are smaller than 10 nanometres. Noteworthy is the Taiwanese company TSMC, which is the world’s largest and most valuable semiconductor company. It has a market cap of $400.1 billion (Reiff et al., 2023). Due to its high market share, the output of Taiwanese production affects almost every high end industry globally (Haeck & Westendarp, 2022). Figure 1 shows the world’s dependency on Taiwanese and South Korean advanced microchip production (smaller than 10 nanometres).

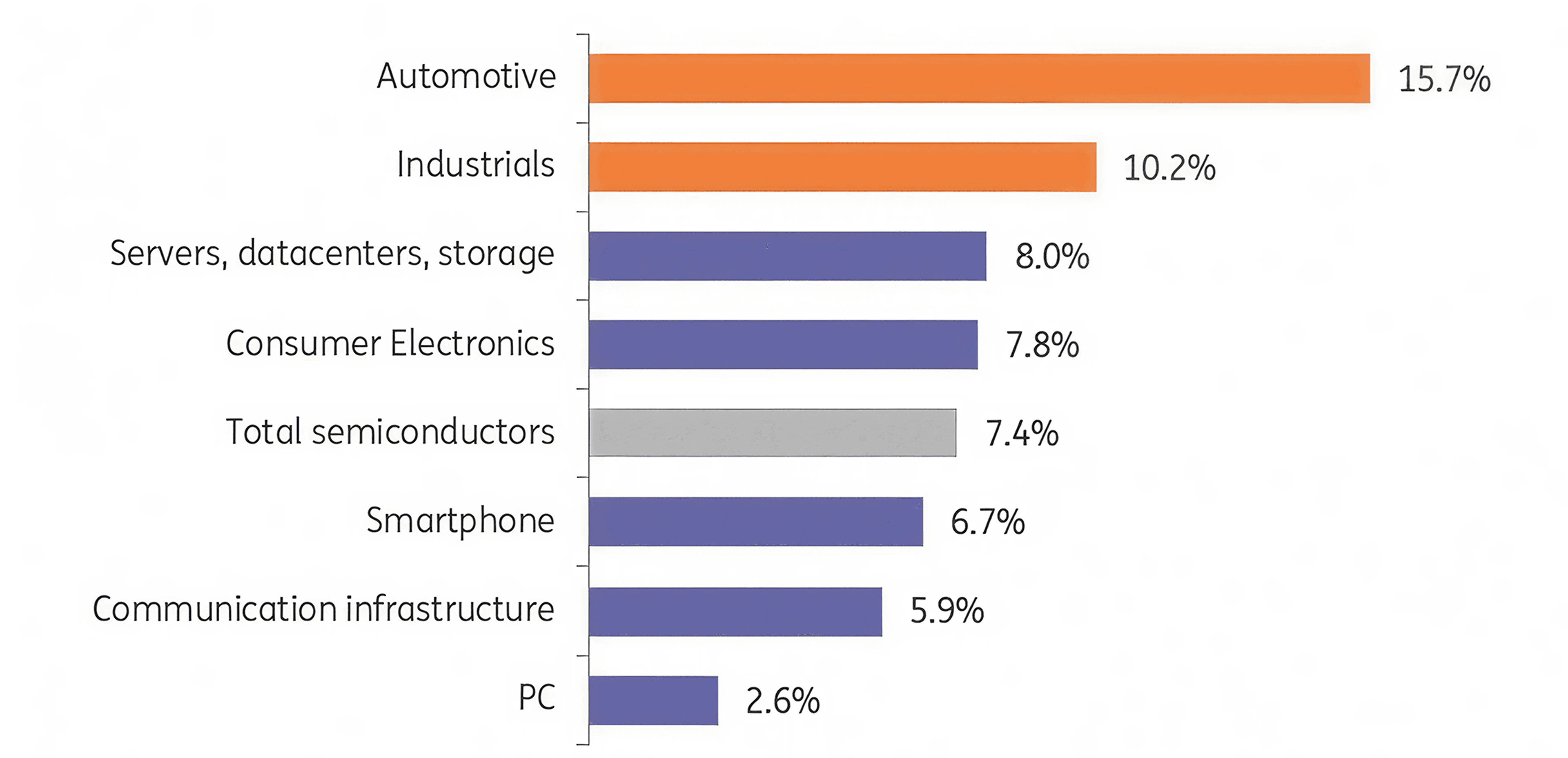

Luckily for Europe, it is expected that semiconductor demand will have the highest growth in the automotive and industrial sectors until 2025 (ING, 2022; Omdia, 2022; Gartner, 2023). Consequently, Europe can profit from supplying two markets in the future that are naturally considered its strengths and expect high growth (see Figure 2).

Our exceptional general aviation development involves proprietary developments to increase efficiency through the installation of new components and is strictly confidential and accessible only to LLP – partners

Project for the production of diesel aircraft engines based on the proven certified engines of the Walter Micron 3 and Walter 6–III–S series

We are fundamentally convinced that….

The general aviation aircraft market and the rapidly developing market for small passenger transport machines are dependent on the existence of a reliable certified light engine unit with high combustion efficiency, long service life and operational safety. The development of this segment is conditioned by these parameters. At present, the entire segment almost exclusively use the American Lycoming and Continental engines and European Canadian Rotax engines.

In the past, due to the need for a new power unit based on a gasoline rather than a diesel concept, several attempts were made to build and certify such engines. The most famous segment is probably the Thilert engine built as a conversion of a Mercedes car engine. It gave rise to the Austro engine, which continues to use automotive technology and is therefore disqualified for broader applications. Another attempt to promote the diesel engine in aviation was by the company SMA, which as part of the state-owned company Safran had almost unlimited resources for the development of a purely aircraft engine. For many reasons that are beyond the scope of this introduction, the development of the SMA engine failed and the engine did not succeed. The reason is mainly the high torsional vibrations that are inherent to this engine despite all the efforts of the designers. At present, it can be said that the only successfully certified diesel engine is the two-stroke Delta Hawh DHK180 A, which has already passed FAA certification.

This project was supported by an experienced private investor with an amount of at least 105 million dollars and currently has a chance to penetrate the GA market in North America and Europe. And the main reason for the slow penetration of diesel engines is the need to re-certify the engine. Certifying the company and the engine in both America and Europe is very time-consuming and it can be said that this process takes at least 10 years. And it can therefore be stated that the current market for piston aircraft engines consists only of Lycoming and Continental engines supplemented by Rotax engines in the ultralight aircraft segment. The DHK 180 engine has also entered the market, which is, however, a two-stroke engine and precisely because of this feature it will be hindered on the market. Although it can be stated that it is likely the most advanced aircraft engine design that is certified by AV, in the coming years it will be available for general aviation aircraft to fully utilize the market potential. It is therefore necessary to introduce other diesel engines to the market in a short time, mainly because the Avgaz LL 100 fuel will be completely banned in 2030 and the operation of gasoline engines will be considerably complicated by this fact.

Therefore, the introduction of another diesel engine into this segment is and will be a very profitable matter. The project has already developed beyond the basic technical solution. Design documentation and several prototypes designs are available, but it is necessary to continue developing the manual version of two types of six-cylinder aircraft engines and one type of four-cylinder aircraft engine. Complete financing of this project requires an amount of approximately 100 million euros.

Our exceptional and prime planed mineral oil development is an energy saving development and is strictly confidential and accessible only to LLP – partners

We are fundamentally convinced that…. The mineral oil market size has grown strongly in recent years. It will grow from $4.2 billion in 2024 to $4.46 billion in 2025 at a compound annual growth rate (CAGR) of 6.3%. The growth in the historic period can be attributed to industrialization & urbanization, medical device applications, electrical industry demand, agricultural use, petrochemical expansion, pharmaceutical applications.

Mineral Oil Market Driver: Rise In Automobile Industry Drives Growth In The Mineral Oil Market

The increasing expansion of automobile industry is expected to propel the growth of mineral oil market going forward. The automobile industry refers to the collection of companies, organizations, and activities involved in the design, development, manufacturing, marketing, and sale of motor vehicles. Mineral oil is commonly used in the automobile industry as a base oil for the production of lubricants, including engine oils, transmission fluids, and hydraulic fluids. Its lubricating properties help reduce friction and wear in various automotive components, enhancing overall engine and vehicle performance. For instance, in February 2023, according to the European Automobile Manufacturers Association, a Belgium-based automobile association, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Therefore, the increasing expansion of automobile industry is driving the growth of mineral oil market.

Our exceptional and prime planed healthcare development is one sources saving development and is strictly confidential and accessible just for LLP – partners

We are fundamentally convinced that….

The next decade will witness a paradigm shift in the focus of novel drug modalities—such as gene therapies, RNA-based treatments, cell therapies, and protein degraders—from rare diseases to large-scale chronic conditions to treat the masses (yes, including cancer), either as a pivot or a complementary expansion. This transition will be driven by advancements in technology, market dynamics, and the continued evolution of drug development.

Today, small molecules and antibodies dominate drug modalities. However, antibodies once were a “new modality”, too. The first monoclonal antibody was approved in 1986, after initial generation in 1975. This drug, Orthoclone OKT3, was approved to prevent kidney transplant rejection, limited to rare, acute cases.

Today, antibody therapeutics represent a >$230B market, and growing. We see a similar analogy in “novel modalities”: just as monoclonal antibody technology sparked excitement in 1975, the development of CRISPR gene editing in 2012 along with other new drug approaches ignited a similar wave of enthusiasm. We predict we’re entering a decade-long shift towards genetic medicine and other novel modalities expanding scope to large, chronic conditions as a mainstay of drug development and personalized medicine.

There are three key drivers behind this shift:

- Technological maturation: Like antibody drugs were initially constrained by efficacy, immunogenicity and other safety issues, genetic medicines and other novel modalities have faced challenges with specificity and efficiency of delivery, off-target safety concerns, and reimbursement challenges. Similar to how antibody technology progressed from murine to chimeric to humanized antibodies, novel modalities are undergoing similar refinements. This opens the door for the biotech ecosystem to leverage these newer modalities to address the multifactorial complexities of chronic conditions like diabetes, cardiovascular diseases, and neurodegenerative disorders.

- Economic imperatives: The success of GLP-1s (which some analysts predict will be a $100 billion market) have further increased the entire industry’s focus on large, chronic diseases given their immense market potential. As manufacturing techniques mature for these newer modalities, sufficient cost of goods sold (COGS) reductions will be critical for commercial viability. Expanding the application of these modalities to chronic conditions unlocks larger markets, aligning pharmaceutical innovation with sustained financial viability. Additionally, given severalprovisions in the Inflation Reduction Act (IRA) that may impede incentives to develop drugs for orphan indications, drug developers may feel the need to explore larger chronic conditions with these newer modalities, though the future of this legislation remains uncertain in the upcoming administration.

- Integration with precision medicine: Advances in genomics and biomarker discovery enable stratification of patients with chronic diseases into subgroups that closely resemble the genetic clarity of rare diseases. This precision reduces the risks associated with targeting large, heterogeneous patient populations.